Arpad Soltesz (ICJK)

Anita Komuves (Atlatszo.hu)

Szymon Krawiec (Fundacja Reporterow)

Eva Kubániová (Investigace.cz)

Szabolcs Panyi (Direkt36.hu) 2019-07-18

Arpad Soltesz (ICJK)

Anita Komuves (Atlatszo.hu)

Szymon Krawiec (Fundacja Reporterow)

Eva Kubániová (Investigace.cz)

Szabolcs Panyi (Direkt36.hu) 2019-07-18

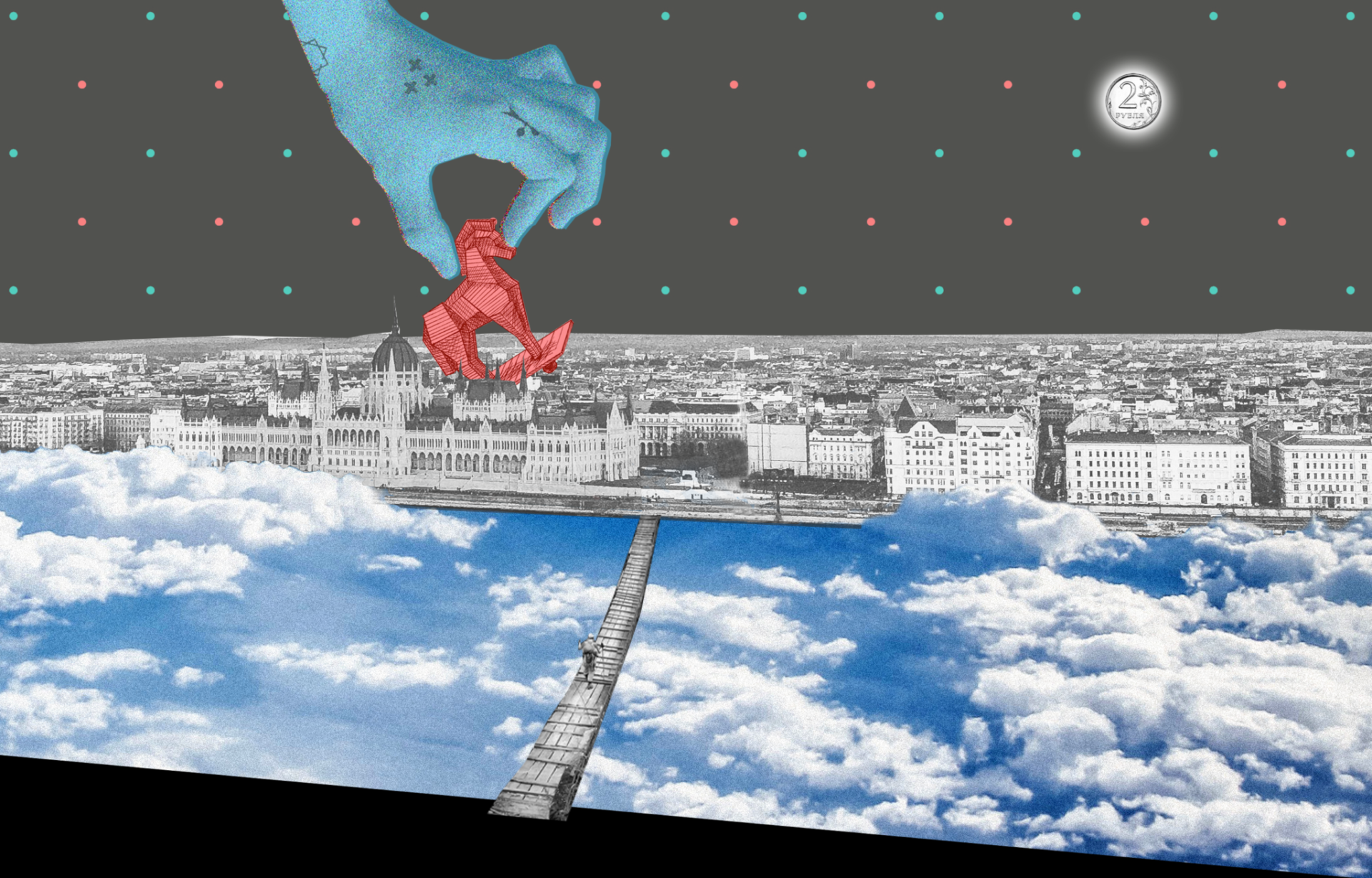

The management board of the Russian-led International Investment Bank (IIB) held its first meeting in its new headquarters, Budapest, this week. The move of IIB from Moscow to Budapest has been controversial since it was announced: experts, historians and the media have been worried that the bank would be a tool for the Kremlin to plant spies in the EU or launder money – which both IIB and the Hungarian government denied several times, claiming that it was a regular international bank. However, a regional overview by VSquare reporters reveals that out of the Visegrad countries, it was only the Hungarian government that did not have reservations about IIB. Poland left the bank in 2000 and never returned, the Czech government tried to block certain parts of the new charter of the bank and then Slovak president Andrej Kiska withdrew his support for IIB opening an office in Bratislava.

The International Investment Bank was founded in 1970 with the aim of supporting trade within the Soviet bloc – to create the communist alternative of the World Bank or the European Investment Bank.

It was too small to fulfill this purpose and that has not changed even today. Its capital is 326 million euros, comparing to the capital of the European Investment Bank, which is 243 billion euros. Today, the biggest shareholder of the bank is Russia (46.03 percent), while the others are Bulgaria (12.95 percent), Hungary (12.27 percent), the Czech Republic (11.47 percent), Slovakia (6.59 percent), Romania (7.04 percent) and with smaller shares Cuba, Vietnam and Mongolia are also members.

Expanded board meeting of the International Investment Bank in January 2018; photo source: http://government.ru

By the 1990s, after the fall of the Soviet Union, it was ‘hybernated’ and practically ceased working. Hungary left the bank in 2000 – at the time when Viktor Orban was prime minister of Hungary. The Hungarian government claimed that the bank was ‘inefficient.’ Poland left within the same year.

Hungary returns to IIB, IIB goes to Hungary

The Russian government decided to revive IIB in 2012, and appointed Nikolay Kosov to do the job. Very soon after that, in the beginning of 2013, the government of Hungary – still under the leadership of Viktor Orbán – signalled its interest in re-joining the bank, which eventually happened in 2015.

The Hungarian Ministry for Economy told the official Hungarian New Agency, MTI in 2014 that the government of Hungary left the bank in 2000 because it had been non-transparent and inefficient. However, according to the Ministry, the bank was transformed and from then on was working according to the best practices of the international banking community and was expanding in a dynamic manner. The ministry also mentioned IIB’s improved credit rating. ‘Weighing these changes, the decision to re-join was made,’ the ministry told the news agency.

After a meeting between Viktor Orban and Nikolay Kosov in Budapest in January 2019 where they spoke about the move of IIB to Budapest, Orban’s spokesman told the MTI that ‘the Hungarian government believes that the move of IIB’s seat to Hungary will strengthen Hungary’s role as an international financial center. There are five supra-national development bank HQ’s on EU territory but none of them are in Central Europe. This means that IIB’s move to Budapest can be regarded as a step forward.’

Shortly after this, the government of Hungary invited IIB to move its headquarters to Budapest. The fact that Orban’s government initiated the move and that the offer was made shortly after the country re-joined IIB was confirmed by both IIB officials at their June 25 press conference in Budapest and by the press secretary of the Czech foreign ministry who answered VSquare reporters’ questions.

It’s official. @IIB_Press has relocated its headquarters to Budapest to become the first #MDB with HQ in #CEE region. Official press conference of the management board was held in the Hungarian capital today pic.twitter.com/q6sxz8A6bU

— Anna Lvova (@Lvova_AA) June 25, 2019

Non-Russian Russian bank

IIB’s leadership often denies that the bank should be categorized as a ‘Russian’ bank and it claims that it is an international organization. However, Andras Racz of Hungarian think tank Political Capital reviewed the founding documents of IIB and concluded that its management and decision-making are both dominated by Russia. He told VSquare reporters that, according to these documents, the day-to-day management of the bank (lending, hiring, financial operations) is completely controlled by its Russian chairman, Kosov. This is usual for bank management. However, the supervisory structures of IIB (the board of governors and the board of directors) are also controlled by Russia because at these levels all decisions need to be made by a ¾ majority, for which country representatives’ votes count based on their country’s shares in IIB. As Russia has more than 46 percent of the shares, this means that no decision can be taken against Russia’s will.

The Kremlin’s influence over the allegedly independent international bank is raising many concerns among foreign diplomats, historians, analysts and political commentators, especially in Hungary. They are all afraid IIB might be a tool for the Kremlin to base intelligence agents inside the EU under the bank’s cover and that IIB might be a tool for money-laundering. Renowned Hungarian historian Krisztián Ungváry, for example, said in a interview that letting IIB into the country was equal to ‘treason’ and that ‘the management of the bank are most probably undercover intelligence agents.’

The bank has already moved to Hungary, but the controversies have not ended yet: the final location of the bank’s offices has not been picked yet. Hungarian daily Nepszava reported in June that IIB is considering to choose Lanchid Palota (Chain Bridge Palace), a very expensive office building on the riverside in Buda, on the west bank of the Danube in Budapest as their new home. According to the legislation on IIB passed by Hungary’s parliament in March, it is the Hungarian government’s responsibility to provide the bank with an appropriate office. IIB’s vice-chairman, Georgy Potapov confirmed in an interview with the daily that Chain Bridge Palace is indeed an option.

Potapov also revealed that IIB will employ about 110 people in Budapest, which is much more than initially reported. In April, VSquare partner Direkt36 wrote that the Hungarian parliament’s Committee on National Security received a briefing from Hungarian counter-intelligence where a total staff number of only 30-40 was mentioned.

Potapov also said that IIB will leave about 25 of its staff in Moscow, including their IT and administrative department, but he did not elaborate why. “We are not spies, we are not a spy organization, that is not the reason why we are in Hungary”, IIB’s vice-chairman stressed in the interview. However, Direkt36 also reported that the Hungarian government’s delegate to the bank’s Board of Directors, former minister Imre Boros, was accused of having ties to the former Communist secret service previously. Boros denied these allegations.

Poland did not get even one euro cent

While Hungary was happy to invite IIB into the country and provide its employees with diplomatic immunity, other Visegrad countries had their reservations. Poland, the Czech Republic and Slovakia are all trying to distance themselves from IIB in one way or another, or they are, at least, not willing to uncritically fulfil all the requests of the bank.

Poland left IIB in 2000: it was in 1999 that the then-president of the country Aleksander Kwaśniewski decided to terminate the treaty between the Polish government and IIB.

The Polish Ministry of Finance at the time explained that IIB’s role “became outdated and it is financially weak and poorly managed”. Moreover, there were ethical questions about whether the vision of the bank fitted foreign policy of Poland. There was also a risk that the IIB would need to be recapitalized as it was on the brink of bankruptcy. Polish officials did not like the idea of investing more money into this project.

Right after the Polish president’s decision, a special inter-ministerial team headed by the Polish Central Bank was formed. The team worked on the basis of the special negotiation instruction ratified by the Polish PM and was obliged to estimate mutual commitments between Poland and IIB. Warsaw was negotiating the return of over half a million zloty (currently over 117 mln euro) – the worth of its shares. However, until today Poland still has not managed to get any money back.

The decision not to pay for Polish shares was made because Poland (and Hungary) applied for the withdrawal when IIB had negative assets.

“The Bank had no liabilities to the Republic of Poland and the Republic of Hungary because per Bank’s estimates, the net assets of the International Investment Bank were negative as of the date the countries applied for withdrawal,” says the official IIB financial statement from 2012.

In 2013, Polish daily “Gazeta Wyborcza” asked the Polish Ministry of Finance whether after 13 years the government finally succeed to get the money back. The answer was no.

“In 2012, based on the Council’s decision, the Bank’s paid-in share capital decreased by EUR 49,247 million (shares of the Republic of Poland and the Republic of Hungary)”.

Poland had a 59,1% stake in this sum, which accounts for approximately 29 million EUR. This is the amount of money which should be paid by the IIB to the Republic of Poland.

VSquare’s reporters asked the Polish Ministry of Finance whether the IIB did so. “The IIB debt to Poland still accounts for 29,15 million EUR” – the ministry replied in May. After so many years the IIB did not pay Poland even one euro cent.

Czech Republic: better safe than sorry

In 2014 the negative Polish experience made the new appointed Czech Minister of Finance Andrej Babiš to analyse Czech participation in both “Russian” banks: the International Investment Bank and the International Bank for Economic Cooperation (IBEC).

“Babiš wanted to get overview of all shares owned by the state,” recalls Martin Pros, a deputy minister of finance responsible for the analysis during that time.

Czech analysts came with three possible solutions: “Keeping status quo, which was not profitable for the Czech Republic. Leaving both institutions. Or the last option: supporting the liquidation of the IBEC and staying in the IIB, but under the condition of enhancing the IIB’s activity towards the Czech Republic,” described the outcome of 2014 analysis the spokesman of Ministry of Finance Zdeněk Vojtěch.

Czech Republic chose the last option and stayed in the IIB. The Ministry of Finance replied to VSquare reporters inquiry that “the withdrawal from both institutions at the same time would be too risky”. The ministry further explained that Czech Republic was worried about not getting the invested money after leaving the institution as it was in the case of Poland. So they took the initiative in updating the banking documents to better correspond with the Czech requirements.

Czech Republic was at that time the second biggest shareholder in IIB and it had the best rating among the other member countries at international financial markets. The spokesman Vojtěch explained “the active role” of Czech Republic in rewriting and updating the Charter of IIB. He specified that Czech Republic “did not manage to push the prompts about the diplomatic immunity.”

The controversial diplomatic immunity, granted to employees of the IIB, their relatives and guests of the IIB, was signed by all shareholders, only Czech Republic asked for an exclusion. In practice, the IIB’s employees have no diplomatic immunity in the Czech Republic and the exclusion is reciprocal. No Czech employee of the bank has any diplomatic immunity. However, Czech Republic, Slovakia and Hungary are in the Schengen area with the right of free movement. The Czech ministry replied on VSquare reporters’ inquiry that they had not used the exemption so far. The security concerns were raised also in Slovakia, which could play a role in the process of moving the headquarters to Budapest.

Slovakia: veto on the regional office

The IIB chose Slovakia as its first and only regional office in Europe in November 2014 and started the process of negotiating the approval by both Slovak parliament and the president.

Then president Andrej Kiska gave preliminary consent for the establishment of Bratislava’s IIB regional office on April 1, 2015. It was just the beginning of a long process, which should end up with ratification of the international treaty by Kiska. The treaty proposal was firstly discussed by the Slovak parliament, which indeed recommended the president to establish the IIB regional office in Slovakia. Once Kiska gave his preliminary consent, the State Secretary of the Ministry of Finance, Vazil Hudak, signed a bilateral agreement with the chairman of the IIB Nikolay Kosov. This agreement included the establishment of the regional office without further waiting for the final ratification process.

The government material discusses in detail why Slovakia should be a first IIB choice: “Among the IIB member countries, only Slovakia and the Czech Republic have an A’s investment rating from international rating agencies. Only Slovakia uses euro as a national currency, which eliminates currency risk and simplifies the financing of the Bank’s operating costs due to Slovak location. Slovakia is geographically located in the center of the considered states and in terms of transport availability of all European IIB member states seems to be the most suitable place to be.”

“When Slovakia adopted the euro, it has benefited from this currency in terms of monetary stability. Monetary instability was a problem for neighboring countries, especially Hungary and partly the Czech Republic. For Russia, it is convenient to have access to the country, where they do not have to think about the aspect of monetary instability and currency exchange. Especially, if the essence of their interests would be directed towards countries that use the euro, “ explains Martin Reguli, an analyst of Slovak F. A. Hayek Foundation.

The IIB promised that after the establishment of the regional office it would start actively searching for clients and increasing the volume of investments in Slovakia. During this period, the IIB provided loans to several Slovak companies. Most of them were companies operating in the energy sector, one of Russian tools of soft diplomatic power, or having business relations with Russia.

But there were far to many concerns: The IIB even as an international institution was suspected of helping other Russian banks of bypassing the sanctions. Another question was the IIB´s request of unprecedented diplomatic immunity, as Slovakia promised to provide the full diplomatic immunity to the IIB´s employees and their relatives. The immunity could be extended also to grandparents and grandchildren (including adopted children).

And above all were security concerns.

The Slovak president Andrej Kiska played an important role. He took the research on his decision seriously and requested advice from relevant ministries and security offices. It took him almost 40 months to deliver his final veto, while the IIB already launched its Slovak branch based on Kiska’s preliminary consent.

Kiska rejected the treaty on July 10, 2018. “I decided not to ratify the treaty, but also to withdraw my consent to its provisional application,” addressed Kiska his negative statement to the Minister of Foreign Affairs. By his withdrawal Kiska definitively terminated operations of the IIB’s regional office in Slovakia.

Just two months later, Viktor Orban met Vladimir Putin and offered to move the headquarters of the IIB from Moscow to Budapest.

By Hana Čápová (Investigace.cz), Arpad Soltesz (Investigative Center of Jan Kuciak), Anita Komuves (Atlatszo.hu), Szymon Krawiec (Fundacja Reporterow), Eva Kubániová (Investigace.cz), Szabolcs Panyi (Direkt36.hu)