By Maria Maggiore and Laure Brillaud

Public access to company ownership registers is disappearing rapidly across Europe after a court decided to let EU nations close their databases amid privacy concerns. Campaigners, meanwhile, fear the controversial ruling marks a return to fiscal secrecy after years spent advocating for greater corporate transparency.

This article was originally published on www.investigate-europe.eu

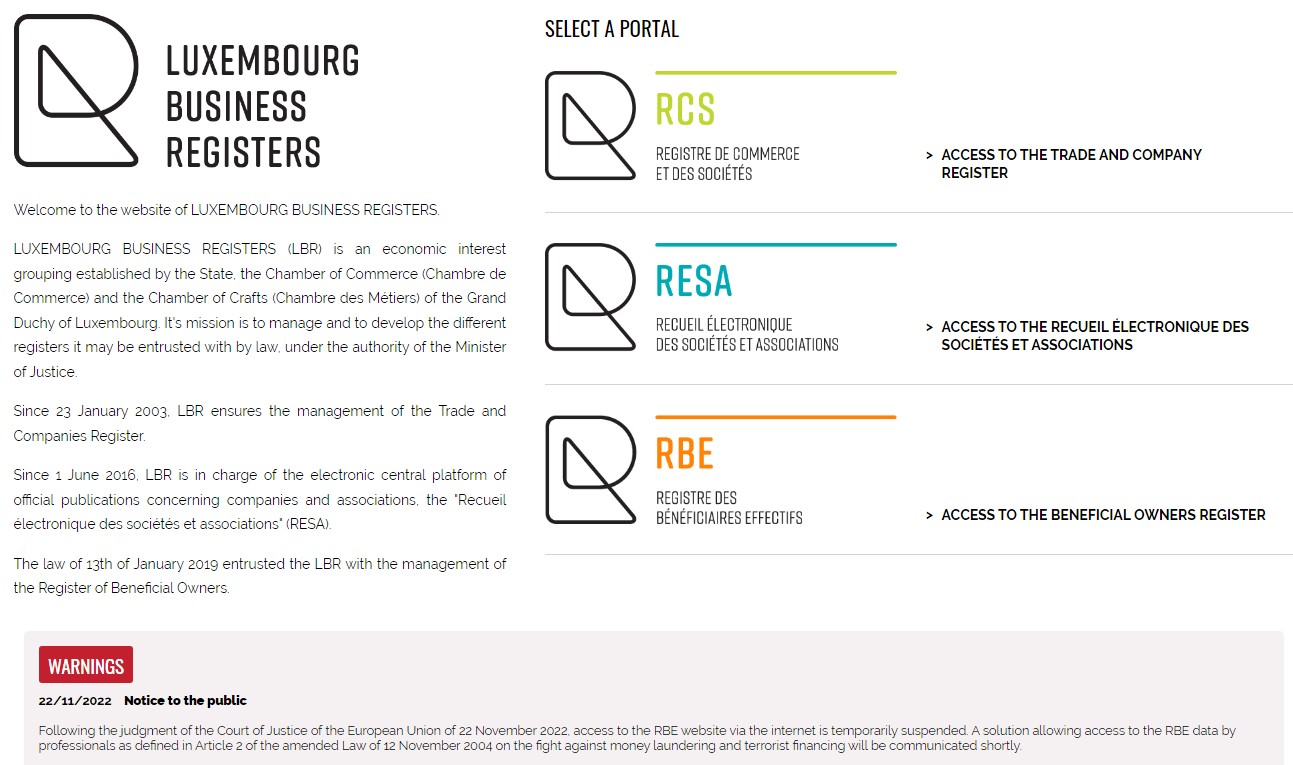

It only took the Luxembourg authorities a few hours to switch off the beneficial ownership register (BO), after the European Court of Justice declared public access to the database was “invalid” in a ruling described by activists as a “blow” to corporate transparency efforts.

Asked to settle two complaints respectively by Sovim SA and the beneficial owner of a real estate company identified as WM, the 22 November judgment stated public access to registries was “interfering with the fundamental rights to respect for private life and to the protection of personal data” guaranteed in the EU Charter.

The next day, the Netherlands, another European country with generous tax policies towards foreign investments, shut access to its own registers. It was followed by Austria, Belgium and Malta. On 30th of November Germany also announced it did shut down public access to its “Transparenzregister” immediately after the ruling was announced.

It was only in 2018, under an EU anti-money laundering directive, that member states were obliged to start keeping registers on the ultimate ownership of companies. What followed was a patchwork of systems offering varying degrees of transparency – if at all.

The November ruling came as a shock to NGOs fighting for corporate transparency for years, and also to journalists, who use the registers to try to unmask the true owners of otherwise opaque companies.

“There is no reason why a person creating a company should keep it secret,” Maira Martini from Transparency International told IE. “It comes with rights like protection against insolvency and should also come with obligations like transparency. The decision is a blow to beneficial ownership transparency, and it comes when we actually need more information to be available, not less.”

Graham Barrow, a transparency activist and founder of the Dark Money Files podcast, regularly screens the UK public register to identify anomalies or red flags. He rails against the idea that competent authorities alone could carry out such research.

“I think much of the work I, and others, have done using the UK register, which is fully, freely and publicly accessible, shows that, with enough people putting in the effort, the register can be a primary source of potential criminality. By which I mean it can provide the grounds for an investigation rather than just providing supporting evidence for an existing one.”

The ruling could further inspire laggard countries that have no BO register in place yet, namely Italy and Spain, or not fully up and running ones, like Greece and Cyprus.

“The ruling will not affect the establishment of a BO registry in Italy, which remains an obligation under the EU Anti-money laundering regime,” says Professor Michele Riccardi of the Transcrime research centre at the Catholic University in Milan. He says the ruling risks, among other things, limiting the capabilities of local governments to adequately screen the integrity of public procurement, and it could also create a “chaotic secondary market of BO data exchangers, providers and resellers, benefiting only some and not the public good”.

The European Court’s decision has revived an old debate on the ‘legitimate interest’ in knowing who the final owner of a property is. Should everyone know who hides behind a company or only people with a legitimate interest like activists and journalists?

“Today’s judgment represents a victory for data protection and the Rule of Law in an extremely politicized context,” said Filippo Noseda, a partner at the London-based law firm Mishcon de Reya who represented WM in the Luxembourg case.

MEP Damien Carême is more moderate in his assessment. “The Court is right to carry out a proportionality test and to ensure that the infringements of these fundamental rights are justified and strictly necessary for the fight against money laundering,” he told IE. “However, the Court is particularly severe in its analysis.”

The Luxembourg Business Register closed to the public immediately following the 22 November court ruling. Source: Investigate Europe

A patchwork of EU standards

Until 2018, there was no obligation in the EU to declare who was behind a company. It was only following publication of the Panama Papers, a huge leak of confidential information on more than 200,000 offshore companies and their shareholders, that the European Commission moved to introduce greater transparency standards.

“Public access to beneficial ownership information allows greater scrutiny of information by civil society, including by the press or civil society organizations,” the commission said at the time. Today, a veil of caution has descended on the Berlaymont building. “The Commission will thoroughly analyze the implications of the judgment in order to assess what amendments are required to the EU framework,” a spokesperson said.

After lengthy negotiations, the European Council found a qualified majority to make ‘beneficial ownership’ registers mandatory for member states in 2018. The problem is that countries were left free to create their own registers. The result has been a patchwork of unconnected ‘beneficial owners’ registers, which, only in theory, are accessible to the public.

In practice, in many cases, one has to pay to know the identity of a company’s owners. Only Denmark, Estonia and Latvia have made their registers available in open data, the golden standard for transparency, while other countries have introduced access restrictions. For example, in Germany or Hungary, one has to pay for data. In Belgium or Portugal, one must be a resident to interrogate BO registers. Before its shutdown, the Luxembourg register limited searches by company name or number. There was no possibility to search by the name of a person to check for all companies that person owns in Luxembourg.

Italy has had a law ready since 2018, but it is yet come into force. “The UBO register will not solve all the problems, it will report the names of the beneficial owners of the companies in Italy”, Prof Riccardi says. “But if one needs to do an analysis of an ownership structure, to also understand any anomalies related to the ownership structure, the BO register can be only of little help”.

Illicit activity flourishes

A case in point is the real estate sector, where the lack of transparency makes investments of illicit origin more attractive. “Real estate is a good way to launder money and those who do that are ready to pay more than the market price, because they can turn illegal funds into legal assets,” says Lucas Millan, from Tax Justice Network. “This inflates real estate prices and disadvantages normal people.”

An analysis of 49,000 real estate properties in Lombardy, conducted by the Transcrime Unit at the Catholic University of Milan, showed that more than 40% had “at least one element of anomaly”.

“Real estate in European cities is a safer investment,” according to Gian Gaetano Bellavia, a money laundering expert in Milan. “These people don’t look at profitability. They look at capital preservation.”

„Legislative loopholes”

While several EU nations rushed to close their registers in recent days, existing rules contain glaring loopholes, making such scrutiny of corporate structures already difficult.

First, the obligation to declare their beneficial owners is only for companies registered in the country. It does not apply to foreign companieswith no domestic legal presence in the country.

“If you set up a company, let’s say in the British Virgin Islands and buy a property in Paris, you are not legally required to first open a subsidiary in France, which is a condition to disclose beneficial ownership information,” explains Transparency International’s Martini. “You can simply buy the property directly without having to register.”

New rules proposed by the European Commission in July 2021 could partially close this gap. If adopted, the amended text would extend the obligation to register beneficial owners to non-EU legal entities entering into a business relationship with real estate or buying real estate in Europe. The current proposal would not beretroactive, however, and would only be valid for future purchases.

The other big loophole is that the registers are obligatory only for individuals owning 25% of shares or more. In Luxembourg, where investment funds manage some trillion euros in assets, Transparency International found 81% of them did not declare any beneficial owner. And even when the name of a physical person is indicated, there is no guarantee that it is the true owner, it could simply be a middleman, a lawyer or the fund administrator.

And even with better rules and implementation, there is still a long way to full transparency on whom owns the building next door. The problem is that the beneficial ownership registers only apply to company shares and do not include assets like properties or luxury goods. So, one can learn who manages a real estate fund, but not what properties this fund owns and, especially, how it bought them.

To get this information, a cross-check with the land registers is necessary. However, this is not easily done in any EU country where public real estate data is often of poor quality, behind a paywall, or found only across various registers and formats.

In Germany, real estate data is not fully digitalised and scattered across multiple decentralised registers. Data from the land registration offices are accessible only for persons with a legitimate interest like journalists or lawyers but not for civil society organisations in general, and fees are often charged. The government has announced plans to link beneficial ownership and real estate registers, but the latter lack a common software format and according to experts familiar with the projects, it could take up to 13 years to create a unified federal real estate register.

A global approach?

Financial markets are global, so should also be the register for beneficial owner. Its scope should, according to French economists Thomas Piketty and Gabriel Zucman, co-directors at the World Inequality Lab, also extend to cover all types of assets including properties.

Transparency International’s Maira Martini agrees and says the EU should start piloting a global asset register to collect “beneficial ownership information for all the assets held in EU countries: private equity, hedge funds, all types of investment funds and all types of assets from property to luxury goods.”

But such a model feels a long way from becoming reality. If EU governments were as quick to fully support efforts for a global register as the Luxembourg authorities and others were in shutting their beneficial owner registers, Europe might not be on the brink of a return to a corporate ownership blackout.

Editor: Chris Matthews

Disclaimer: Laure Brillaud led Transparency International’s work on Anti-Money Laundering until July 2021. From July 2021 to March 2022, she attended a Fellowship with Investigate Europe and has since continued to work as an independent freelance journalist.