- The Orbán government tried to help unfreeze the funds blocked by European authorities and tried to help the Russians avoid direct Western sanctions

- Hacked emails expose the behind-the-scenes operations of the International Investment Bank against Czech Republic and Slovakia, which just quit the bank

- Poland is still trying to retrieve its money after a similar withdrawal more than two decades ago

Authors of the article:

– Szabolcs Panyi (VSquare/Direkt36)

– Kamilla Marton, András Pethő, András Szabó, Zsuzsanna Wirth (Hungary/Direkt36)

– Tomas Madlenak, Lukas Diko (Slovakia/ICJK)

– Hana Capova, Zuzana Sotova (Czech Republic/Investigace.cz)

The International Investment Bank (IIB), a Russia-linked bank in Budapest, sounded very confident on February 24 last year, the day Russia invaded Ukraine. In a statement issued that day, it said that “recent geopolitical events do not in any way affect the Bank’s operations, the implementation of its strategy, or the fulfillment of its obligations to investors, partners and clients.”

Behind the scenes, however, panic quickly spread within the bank.

In the days and weeks that followed, the IIB management grew increasingly alarmed as a European financial institution blocked the bank’s funds, citing sanctions on Russia. Several member countries announced their withdrawal from the IIB in protest against Russia’s war, and even credit rating agencies issued increasingly negative assessments of the bank.

Founded in 1970 to create a possible alternative to the World Bank or the European Investment Bank for the Socialist bloc, the Moscow-based IIB went dormant with the collapse of the Soviet Union. It was revived in 2012 to support the expansion of Russia’s financial interests. Nikolay Kosov, a financier and former diplomat from a family of high-ranking KGB operatives, was tapped for the job as chairman. However, the IIB remained a rather small institution with a paid-in capital of €424.87 million euros as of January 2022, a few weeks before Russia’s invasion. Other shareholders besides Russia and Hungary – which re-joined the bank in 2015 – included Cuba, Mongolia, Vietnam, as well as the countries that announced cutting ties with the IIB in February last year: Bulgaria, Czech Republic, Romania, and Slovakia.

According to one of the bank’s internal documents, the mere exit of member countries “destroyed much of what we had achieved in two days.” In another document, it was said to have “paralyzed the Bank’s operations.”

These documents are part of a package of internal documents allegedly leaked from the IIB in February of this year. The files were allegedly obtained by an unknown hacker group calling themselves ‘Karma_byt3s’ and published online. The IIB admitted that the financial institution’s systems had been hacked, but the bank also claimed that “fake e-mails” had started to circulate as a result of this hacking.

VSquare and its investigative partners Direkt36, ICJK, and Investigace.cz have also obtained the documents leaked by the hackers. We have analyzed and compared them with information previously obtained about the bank, as well as contacted a number of institutions that were linked to the IIB, according to the documents. Our cross-checking did not reveal any information that would call into question the authenticity of the leaked documents. We also sent a detailed set of questions to the IIB, which said that they would only respond if all their replies were provided verbatim and in full. We indicated that we could not make such a commitment to anyone, but promised to publish the substance of their replies.

They did not respond to this, nor to our detailed follow-up questions, but they also did not dispute the authenticity of the documents we cited.

The leaked documents – some of which the Hungarian weekly HVG had reported on earlier – reveal not only that the bank was in a catastrophic situation because of the war, but also that Hungary was the main ally and support of the majority-owning Russians. Officials in the Orbán government tried to help unfreeze the funds blocked by European authorities, and took steps to help avoid direct Western sanctions by plotting possible new shareholding structures that would officially keep Russia’s ownership below 50 percent.

Meanwhile, internal documents and emails show how the IIB’s management plotted to avoid payouts to the bank’s four withdrawing EU member states, including the Czech Republic and Slovakia.

People hold signs at a protest organised by Hungary’s opposition members, outside the headquarters of the Moscow-backed International Investment Bank, after Russia’s invasion of Ukraine, in Budapest, Hungary, 1.03.2022. Source: MARTON MONUS / Reuters / Forum

The Russian invasion of Ukraine refocused Western allies’ attention on the bank. They had been concerned in 2019, when the financial institution formerly based in Moscow moved its headquarters to Budapest with the active support of the Orbán government (the bank’s affairs were exposed by VSquare and its investigative partners Direkt36, ICJK, Investigace.cz and Atlatszo in several articles at the time).

However, the leaked documents reveal more clearly than ever that the Hungarian government considers cooperation with the Russian-dominated bank extremely important, even in the face of the war, and even at the cost of going against its Visegrád allies.

We sent comment requests to multiple Hungarian government representatives but received no response.

1. The Leavers

On March 4, 2022, eight days after the outbreak of war, the IIB received an email containing unpleasant news for the bank.

The IIB had months earlier been invited to a conference of the European Investment Bank (EIB), the EU’s financial arm, scheduled for May 2022, but now the EIB has essentially canceled the invitation. The organizer of the conference told one of the invitees that the presence of IIB staff at the conference “would not be entirely appropriate” in light of “geopolitical events.”

Bank officials got the message. One of the bank’s senior managers forwarded the letter to a colleague saying it’s ”very difficult to comment on, but it’s pretty laconic and clear.” He added that the international community participating at the planned conference on risk management “doesn’t want to meet/talk to IIB.” (EIB confirmed that they have indeed withdrawn the invitation to IIB.)

The episode was a clear sign of the Russian-led bank’s international isolation. But it had bigger problems than the canceling of the conference invitation.

The Czech Republic announced its withdrawal from the IIB on February 25, the day after the war broke out, and called on other EU countries that are members of the bank to do the same. With Hungary’s exception, Romania, Slovakia and Bulgaria all followed suit. Although these countries announced their departure, the exit process took several months, during which time serious tensions developed between those leaving and representatives of the remaining countries, especially with the Russians.

For example, on March 31, the four exiting countries (later referred to as the European 4) sent a joint letter to the then-IIB Chairman Nikolai Kosov demanding that the bank strictly comply with EU and other international sanctions against Russia and Belarus, and asking that a resolution to that effect be adopted by the bank’s governing bodies.

A leaked correspondence reveals that the bank’s management was trying to maneuver to avoid taking any clear position. On the one hand, they considered the four countries’ proposal “too political,” which Russia would be likely to block anyway. On the other hand, they believed that voting against the proposal would give the European 4 a trump card, as it would suggest that the IIB did not want to comply with sanctions.

In the course of the discussions, it was suggested that the bank’s management should ask Hungary to submit an alternative, more neutral resolution proposal, thereby setting a trap for the exiting countries. If “the European 4 vote against, it is they themselves then blocking such a decision, we would have the ability to fight back against them,” suggested Elliott Auckland, the bank’s Chief Financial Officer (CFO). The European 4’s proposal was finally put to a vote by the bank’s Board of Governors a few months later, where it failed due to abstentions by Hungary and Russia. Russia’s other three staunch allies, Cuba, Mongolia and Vietnam, with minimal shareholding in the bank, openly voted down the statement calling for sanctions against Russia (Vietnam, however, supported the call for sanctions against Belarus).

The tension over the European 4 has also been felt in other areas of the bank’s operations. In a letter at the end of March, Russian deputy finance minister Timur Maksimov, who represents Russia on the IIB’s Board of Governors, informed the Russian deputy energy minister that the IIB would not be able to provide the 1.3 billion roubles needed to complete a planned hydroelectric power plant project in Karelia, Russia. He explained that the departing European 4 members still sit on the decision-making bodies of the financial institution and because of their attitude, it is “obvious that the Bank will not be able to obtain the necessary approval.”

There has also been tension over the issue of settlement, i.e. when and how exiting member countries will get back their paid-in capital. According to leaked correspondence, the bank’s management, after some discussion, concluded that it would be best if the countries who left received nothing, a proposal dubbed the “zero option.” (Bulgaria had €42.2 million, the Czech Republic €37.4 million, Romania €26.1 million, while Slovakia €28.9 million euros as paid-in capital of the IIB, which amounts to €134.6 million euros in total.)

A document labeled “urgent, high-priority” – probably an executive summary – at the end of August suggested that the five remaining shareholder countries of the IIB should band together behind the ’zero-option’ scenario. This implies that the European 4 would not get back a single cent of their paid-in capital, with no exceptions for “their hostile and costly actions towards the Bank. “As with the avalanche of current problems, responsibility for the current situation lies with the four withdrawing members,” the summary assessed.

Leaked email correspondence from bank executives shows they were very angry about the European 4. For example, Czech deputy finance minister Roman Binder wrote to the bank on September 30, 2022, about the withdrawal. While IIB board member Milan Valasek, who also has a Czech background, urged caution for fear of Czech litigation, CFO Elliott Auckland suggested a belligerent approach.

“We shouldn’t be afraid of any court cases. Actually, we should embrace them. The Bank hasn’t caused any damage to the Czech Republic. Czech Republic has caused damage to IIB. This can be proven in a court,” he wrote. But Valasek and Auckland agreed in the emails that they should try to delay the process, noting that earlier defections dragged on for a long time. “Poland, Hungary etc. took years with IIB before when they left (essentially a decade). That is how it will be this time around. We must focus our time and energy exclusively on avoiding default in March 2023,” Auckland wrote, referring to the fact that after democratic transition, those two countries left the bank.

Poland was the first country to quit the bank in 2000. Subsequently the bank unsuccessfully tried to re-enter Poland through the back door, as our previous investigation revealed. Despite repeated attempts by Poland to recover the €29.15 million debt, it never got its money back. The Polish Ministry of Finance told VSquare, “The situation is complicated. We are re-examining the issue in order to find the best solution, also taking into account recent reports on the bank’s situation.”

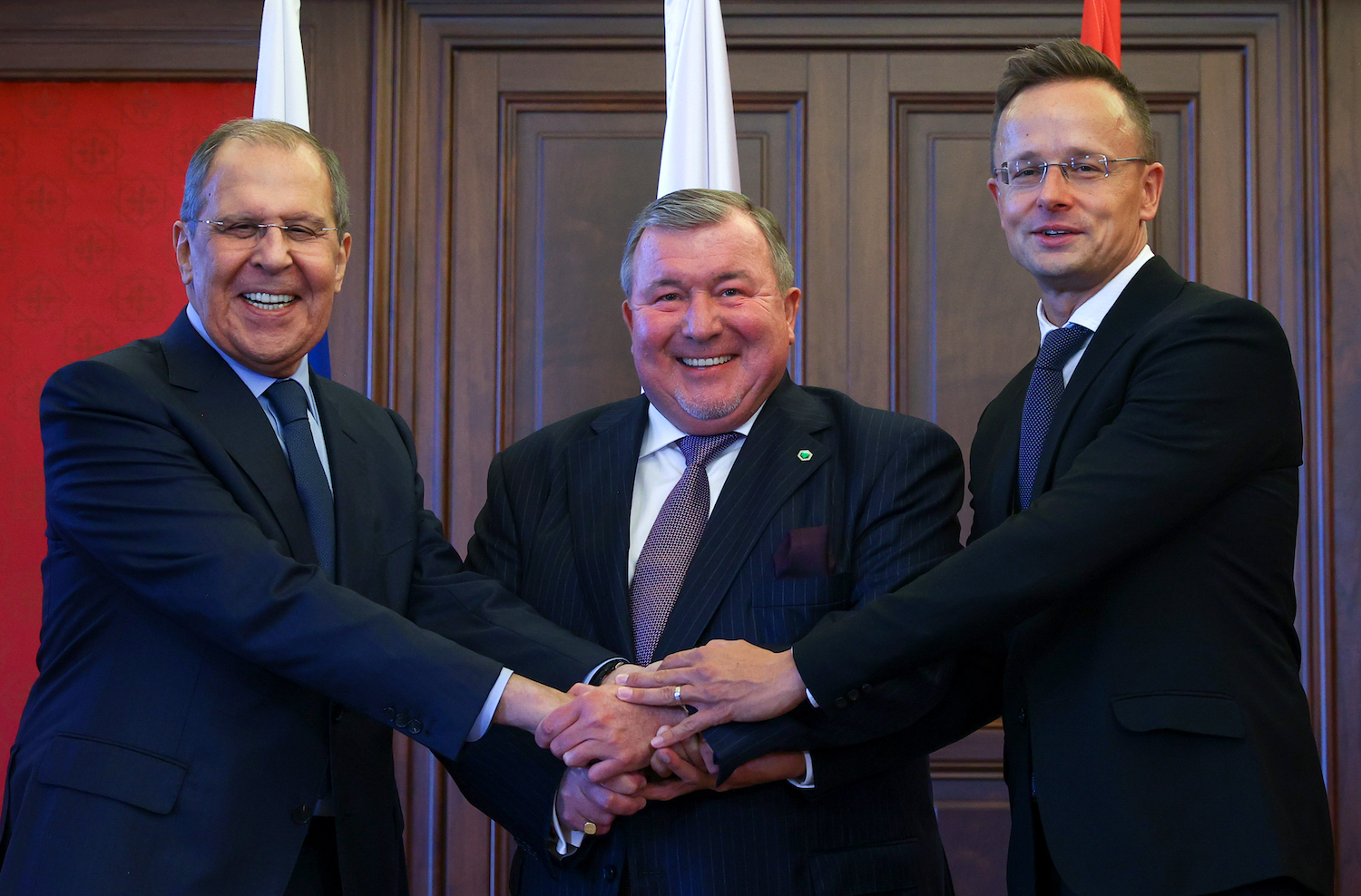

Russia’s Foreign Minister Sergei Lavrov, IIB (International Investment Bank) Board Chairman Nikolai Kosov and Hungary’s Foreign Minister Peter Szijjarto (L-R) pose during a meeting at the IIB headquarters, 24.08.2021, Budapest, Hungary: Source: Russian Foreign Ministry / TASS / Forum

IIB Chairman Nikolay Kosov responded to Auckland’s email by saying that he favored a tougher stance. In another letter, he went further. “Talk less and more rudely to the Czech. They took little interest in the Bank in previous years, did nothing but nasty things, and now they are looking for something,” Kosov wrote in an email. He wrote of the Czechs’ representative that she should be told that her “opinion is irrelevant to the bank,” that “she will write some slander anyway” and that “it would be good to get her to leave as soon as possible.” Other Russian IIB staffers were also explicitly hostile towards the Czechs. For example, a November 8 exchange of messages mocks Czech politicians by referring to their age and sometimes by repeating the acronym “LGBTQ”.

The IIB’s negotiating strategy has thus become that the countries leaving the structures should pay the bank for the damage caused, not the other way around. “My logic is that we should be aggressive (picking an option that leaves them all in the red to IIB), that way, the Zero-Option will be more favorable to them. I also think that such an approach would decrease the threat of court proceedings, as it means that they have something to lose by going to court against IIB,” CFO Auckland wrote in one of the letters. He implied that they should try to convince shareholders who are trying to leave that it is better not to get their paid-up capital back than to have to pay extra to the IIB. He also added that the IIB would of course give in, and ”over time, our negotiations positions might come closer.”

In the end, it seems that the bank’s formal offer to the withdrawing countries – each of their cases will be considered individually and the paid-in capital will be paid back over a long period, delayed and in installments – has softened somewhat from its initial toughness of stressing the ‘zero option’. The bank’s proposal has been to start disbursement as a so-called subordinated financial asset – i.e. in the event of bankruptcy, it will only be paid back after all the claims of the other creditors have been satisfied – with a minimum tenor of 15 years and a grace period of minimum 5 years.

According to the leaked documents, the Czechs and Romanians refused to accept the terms offered by the IIB and demand the full repayment of their paid-in capital as soon as possible, while the Slovaks are willing to compromise. On behalf of Slovakia, for example, Slovak Finance Ministry representative Martin Polónyi, who represents Slovakia on the IIB Board of Governors, has responded in an official letter to the IIB’s offers by saying that they could accept some of their proposals. For example, that Slovakia would have access to its money after 15 years.

In a phone call with ICJK, Polónyi admitted that Slovakia approached negotiations fully expecting to get zero, “Because one thing is what the contract says and on the basis of which the bank was established … and the other thing is some kind of economic reality but also the ratio of votes in those decisive bodies,” Polónyi explains. According to him, immediate full payment of the paid-in Slovak capital was not an option, as the remaining countries would outvote the leaving countries in the Board of Governors. He also claims other options – liquidation of the bank or arbitration – would not be preferable for Slovakia either. Polónyi says that the Slovak Ministry of Finance’s internal analysis for arbitration “didn’t work out in such a way that it would be clear that we would win it.” Similarly, with the liquidation of the bank, “Again, we would end up with zero because all other liabilities would be paid off first before the shareholders” equity would be paid out.

Slovakia left the bank on January 29. “The final amount of the settlement should be approximately €24 million. The repayment profile has not yet been determined and will be part of the relationship settlement agreement,” explains the press department of the Slovak Ministry of Finance.

For the IIB, however, the withdrawal of the four countries was just one of many problems. At least as challenging was the fact that they lost access to some of their funds. This problem emerged soon after the outbreak of the war.

2. The Blocking

On March 28, 2022, an IIB staff member wrote a letter to Belgium and Luxemburg-based law firm Strelia to ask for advice on how to solve a serious problem for the bank.

According to the leaked document, the Belgian-based institution Euroclear blocked the bank’s funds on February 28, last year, four days after Russia started its war.

Euroclear is a financial service provider that registers and administers securities transactions, and as a result, various investors hold money with them. The blocking was linked to the EU sanctions against Russia, as the IIB account was opened by a Russian financial institution, Rosbank. The measure affected significant sums of money. According to leaked emails and documents, the IIB’s year-end summary in 2022 put the amount held on this account a total of 50,1 million dollars, 11,4 million euros, 340 million Hungarian forints and 736,8 million roubles. Calculated at the exchange rate at the time, this amounted to around 75,4 million euros.

The bank argued that the procedure was problematic because the ultimate beneficiary of the assets was not Rosbank, but IIB itself, and that, according to its own argument, they were not subject to sanctions.

“What are the real tools (apart from filing complaints) to influence Euroclear to unblock at least our cash assets and transfer them to our European bank account?” one of IIB’s staff member asked the Belgian law firm, which then started working on the case, sending the invoices regularly and on one occasion apologizing to its client for the slowness of the Belgian administration. (In response to our questions, Strelia replied that their professional rules do not allow them to comment on their customers.)

Another problem was that, following the announcement of the exit of the four countries, major international credit rating agencies downgraded the IIB’s ratings one after the other. On March 17 last year, Moody’s, for example, downgraded the bank to a non-investment grade, explaining that the four member states were unlikely to continue to support the IIB. “Some of the member states have stopped supporting the bank. The bank’s rating has been downgraded because of this,” a source with close knowledge of the bank’s operations told Direkt36 earlier. He added that this meant that the IIB was “pushed out of the financial markets”, explaining that if a financial institution is downgraded, it is much harder for it to obtain credit or other funds from the market than before.

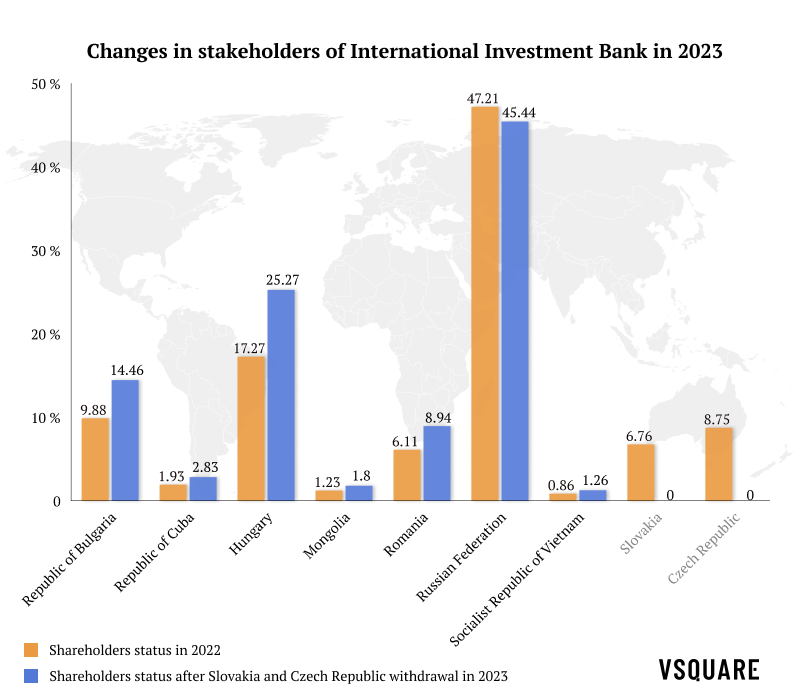

These financial difficulties added up. According to reports from bank officials, various liquidity problems and the blocking of the Euroclear account had made the situation so serious that, by March, IIB was close to bankruptcy. “The Bank has been on the brink of default”, “in March, the Bank faced not at all an unlikely near-default situation”, according to written reports to bank staff. The IIB’s CFO wrote in a document that the only way to get through March 2022 and the period thereafter was to sell part of the bank’s loan portfolio.

This is the situation in which IIB tried to navigate. The leaked document package contains several reports that describe how the bank tried to deal with its dissatisfied customers during the summer. Among them, we found an exchange with two entities based in Romania, raising questions about the IIB’s situation. In the email exchange, there was some discussion about how to respond to these questions, to which one senior executive suggested: “we can scare them a bit, and at the same time, say we are open to buy back their bonds on us (below par)”.

A similar approach is repeated towards another Romanian company, asking about the possibility of redemption. In response, the IIB staff drafts a reply and shares it with colleagues before sending it. He explains his intention with the answers to “scare them a bit, in order to achieve good discount in buy backs”.

According to the leaked emails, “scare tactics” were also used to target the Hungarian subsidiary of a South Korean-owned bank, KDB Bank Europe. “In this letter I would like to scare KDB in order to push them for discount,” a bank executive wrote about this other financial institution that was lending money to IIB.

In the autumn, the IIB was dealt another blow when, after months of failed negotiations, the international audit firm Ernst&Young (EY), which had been auditing the bank, terminated the contract at the beginning of October 2022. EY told IIB that “after careful consideration of all the circumstances” they could not continue the audit.

EY Hungary’s Head of Marketing and Communications, Ágnes Pellion, responded to our inquiry by saying that they could not comment or disclose any information due to the protection of business secrets and confidentiality. However, a senior executive working for a major audit firm explained the move by saying that EY and the other major auditors had all ceased operations in Russia, their local branches had closed, and the service they provided to the IIB had also fallen victim.

The bank eventually contracted an audit firm based in Russia, further strengthening IIB’s Russian ties.

Under these increasingly difficult circumstances the bank has tried to raise funds in different ways. IIB tried to open accounts with Russian and Asian financial institutions to escape the sanctions imposed on some of their bank accounts, and to get money. Or, for example, an email in early June even suggested selling IIB’s Moscow office. The value of the property was then estimated at €48.5 million. IIB’s senior executive who drafted the letter suggested that Hungary should not be informed of the case for the time being. The idea was that the Hungarian government should not think that the IIB could easily solve its problems on its own. “We need to pressure them as the only country who can give us liquidity (and not let them think we can survive comfortably on our own),” the email says, referring to Hungary.

It is not clear from the documents whether the Hungarians were finally informed of the plan to sell the Moscow building, and the Hungarian government has not responded to our questions on this. There’s also no information on whether the plan of selling the Russian headquarters ever went through.

Meanwhile, the IIB’s management was counting on the Hungarians’ help, for example, in solving the problem that the exit of the four Central European member states posed for the Russians.

3. Plan-B

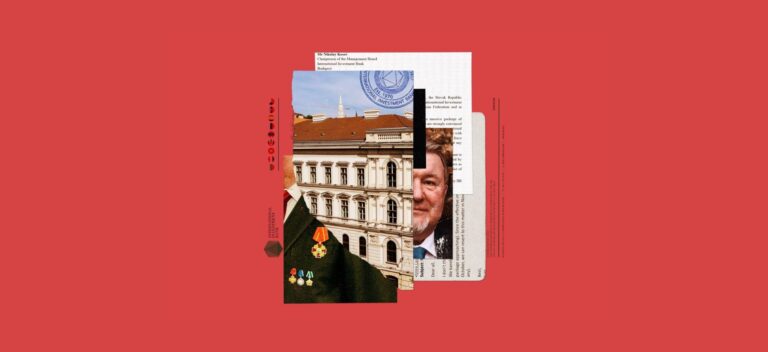

According to the leaked documents, the real concern of IIB’s management regarding the departure of the European 4 was what that would do to the IIB structure itself.The reduction in the number of shareholders meant that Russia, which previously held more than 47 percent of the bank’s shares, would see its ownership share rise to well over 50 percent.

This was something the IIB wanted to avoid at all costs.

An executive summary of the bank’s difficulties suggested that no one would want to do business with a Russian-majority bank, not to mention the possibility that it could be subject to Western sanctions. The threat of becoming Russian-majority has “already closed off any opportunities for opening correspondent and custody accounts, sale of securities from treasury portfolio, access to debt markets. In short, it completely cuts off sources of new funding,” the summary says. In leaked documents and e-mail correspondence, it is a recurring topic, and all bank executives take for granted the scenario of EU sanctions on the bank if Russia becomes a shareholder above 50 percent.

However, as a curious consequence of the geopolitical situation, the IIB is essentially caught between the devil and the deep blue sea. On the one hand, it had to fear Western punitive measures, but at the same time, the bank’s largest shareholder, Russia, already imposed concrete sanctions on it because it was based in Europe. As a result, the IIB’s accounts with Russian banks were suspended, significant funds were frozen, bank transfers and rouble conversions became impossible.

In order to lift these Russian counter-sanctions – two of Vladimir Putin’s presidential decrees on financial sanctions were applied on IIB – the bank has tried to appear as Russia-friendly as possible towards Moscow. For example, according to an e-mail correspondence on August 17, when the Russian Ministry of Finance asked IIB for financial data, CFO Elliott Auckland suggested that IIB’s response should emphasize as much as possible the large size of its Russian portfolio and the importance of the various projects IIB supports to Russia, in order to make the bank look better to the Russian ministry – rather than as a bank of an ‘unfriendly’ countries. (An ’unfriendly country’ is Kremlin terminology for NATO, EU, etc. member states in conflict with Russia who are subject to Moscow’s counter-sanctions.)

While IIB CFO Auckland has previously claimed in multiple documents that the withdrawing countries had caused a dramatic deterioration in the bank’s financial situation, he suggested the opposite as a communication strategy towards the Russian finance ministry. According to him, the bank should emphasize how good it is that Russia’s shareholding is increasing with the exit of the hostile Czech Republic and Slovakia.

However, email correspondence with the Russian state suggests that the management of IIB has been let down by Moscow. Chairman Kosov has tried to persuade members of the Russian government that if they do not help, the IIB will go bankrupt in the crossfire of sanctions. However, the letters suggest that the Russian government and banks in Russia have consistently failed to comply with the IIB’s requests, which has increasingly frustrated Kosov. “These demagogues let you down personally and end up discrediting the Bank,” he said in one of his letters about an issue with Rosbank, the IIB’s custodian in Russia, where Russian counter-sanctions have trapped the IIB’s funds.

However, the IIB leadership has managed to achieve small results. When Elliott Auckland outlines the bank’s situation to the Moscow-based rating agency ACRA in the first half of September, he says in a correspondence that he stresses, for example, how good the strong relationship between Hungary and Russia is despite the sanctions, and that ” we consider the exit of Cz(ech Republic) and Slovakia as good news”, because it will allow the bank to build a more harmonious relationship with shareholders. The argument appeared to be a success, as in a subsequent letter Auckland proudly announced that ACRA had not downgraded the IIB’s risk rating.

While Kosov and Auckland tried to prove to Moscow how pro-Russian the IIB is, at the same time, the IIB’s management wanted Western political and financial institutions to believe the opposite. The main challenge was to avoid Russian majority ownership, for which two solutions were outlined in the summer of 2022: the ’Hungary scenario’ and the ’Serbia scenario’. Both involved Russia passing on parts of its paid-up capital to other shareholders.

According to a document from August 23, 2022, detailing the scenarios, the IIB originally considered the Hungary scenario, i.e. Russia would transfer 67.6 million of its 201.6 million paid-in capital to Hungary, which would then immediately transfer 20 million to Serbia, a new member of the IIB. But in the end, according to the document, “Budapest deemed direct transfer impossible due to the risk that such transactions would fall under EU sanctions that prohibit any investments in Russia.” In other words, the Hungarian scenario failed because “consultants of the Hungarian side opine” that the transfer of Russian shares to Hungary “could be recognized as an investment in the sense of EU sanctions.”

In the next phase, in order to avoid sanctions, the “Serbia scenario” was drafted, according to which Russia would transfer 67.6 million euros of its paid-in capital to Serbia, and Serbia would immediately pass on the bulk of this, 47.6 million euros, to Hungary. The draft said that ”reallocation of shares should be completed within 1 working day”. Using Serbia as an intermediary, which is not an EU member, would have been necessary here to prevent the Russians and the Hungarians from doing business directly, thus avoiding EU sanctions.

The leaked documents also show that although Serbia has shown cooperation, IIB always saw them as an unreliable partner. There was a reason for this, as the Balkan country joined the bank at the end of 2021, but never paid its share of the capital, so its membership was not formalized. Although negotiations were ongoing until the autumn of 2022 , the “Serbia scenario” would have still required Serbia to contribute €20 million to the IIB.

The bank’s management has written several inquiries asking why the Serbs are not fulfilling their commitments. In an exchange of messages in November 2022, for example, a Russian senior manager of the bank wrote that “I have a gut feeling Serbia will fuck us”.

As the Serbs did not pay their capital into the bank, both scenarios eventually failed, and IIB management therefore resorted to an emergency measure, referred to in several places as “PLAN-B”. The idea was that the Russian state would convert part of its paid-in capital into a subordinated loan. This means that the money is not taken out of the bank by the Russian state, but it is re-labelled in such a way that it is no longer officially considered as the Russian state’s paid-in capital.

While the bank’s shareholders’ money is so-called equity, a subordinated loan is borrowed funds, an investment banker explained to Direkt36. “Subordinated debt is a borrowed fund element that represents the weakest claim on the bank. In case of financial difficulty, this is the last claim by borrowers that the bank will satisfy, but still before the paying out the equities,” he added.

The IIB management wanted to convert part of the Russian paid-in capital into a perpetual subordinated loan with virtually no interest, which is officially not considered as capital/equity (and therefore Russian state ownership), but which still behaves as such in almost all practical respects, the investment banker explained.

According to the leaked letters, the IIB was also aware that this was a very unusual solution, but concluded that they had no alternative.

“Swapping equity into subordinated debt is extremely rare – I actually think it probably has never happened, for sure in MDBs [multinational development banks]. Therefore, there is essentially no rules/precedent to base this off,” CFO Auckland wrote on November 9, 2022. However, he, along with the bank’s then-newly elected vice-president Milan Valasek, believes that “if we consider the share of Russia as most critical, then what other option do we have.”

On 30 January 2023, the IIB Board of Governors formalized the ’Plan-B’. Slovakia and the Czech Republic have quit the bank, their €28.9 million and €37.4 million euros will no longer count towards paid-in capital, and Russia has subtracted €69 million from its paid-in capital and converted it into a subordinated loan. This means that Russia’s stake in the bank has even decreased slightly (from 47,21% to 45.44%), while all other shareholders remaining in the bank saw an automatic increase. The largest increase (8 percentage points) is achieved by Hungary, which currently holds 25.27% of IIB shares.

Hungary was already the bank’s second-largest shareholder, but this has strengthened its position even further. Soon the IIB’s management turned to the Hungarian government for help.

4. The Letter

At the beginning of February, a draft letter was prepared, which, according to leaked documents, had Márton Nagy, Hungarian Minister of Economic Development, as the sender, and the Belgian Minister of Finance, Vincent Van Peteghem, as the recipient.

The letter was aimed at convincing Belgium to unfreeze the IIB’s blocked account with Euroclear. The measure, which had been imposed in the days after the outbreak of the war, was still in force and was causing increasing problems for the bank’s management.

At the end of last year, things had seemed to take a positive turn for the IIB. In October 2022, Strelia, a Belgian law firm working for the IIB, informed the bank that the Belgian Treasury had decided to unblock the IIB’s frozen account with Euroclear. According to internal documents, the bank calculated that if they had access to their securities held here, they could meet their obligations to their European and Russian creditors up until mid-2025.

However, the relief proved to be unfounded, as the closure was eventually not lifted. As a result, the IIB became increasingly impatient. “Can we somehow push them?”, “Has there been any response from Euroclear?” – wrote a bank official in emails to the Belgian law firm handling the case in late November and early December last year.

Finally, on December 12, an unfavorable decision was taken, when the head of the Belgian Treasury, Alexandre De Geest, informed the Belgian law firm that the bank would not be able to access its money. This will continue to be the case until the bank can prove that the IIB is not controlled by sanctioned persons or entities. According to the director general of the Belgian treasury, several members of the IIB’s governing bodies are currently linked to the Russian government, for example the Russian deputy finance minister, who is a member of the bank’s Board of Governors.

“The way in which the Treasury handles this case is outrageous and that it seems like they are colluding with Euroclear” – the Belgian law firm commented on the developments in an email exchange with the IIB the following day.

An internal letter was sent to the bank’s management informing them of the devastating effects of the decision: “IIB used up almost all other liquidity reserves in 2022 and as such, without access to its bonds in Euroclear, the Bank will be forced to default or restructure its bonds as soon as May 2023”. The letter claims that they face a deficit so severe that it is “a near impossible task” to make up. (This letter was previously reported by HVG.)

Over the next few days, the bank’s staff corresponded about what could be done about the situation. CFO Elliott Auckland – who claimed the Belgians are blocking IIB’s funds for political reasons – outlined a so-called “evacuation plan”. The bank would agree with the European authorities to somehow get its money back from Euroclear, in return for which it would be used exclusively to pay off their European investors. The IIB would then move out of the EU. Auckland argues that this would reduce the EU’s security concerns and that Hungary could “score points with the West” as a mediator in solving the problem.

The documents did not reveal how seriously this plan was taken, but they do show that the IIB was counting on the Hungarian government’s help. This was indicated by a draft letter signed by Márton Nagy, which stated that Russia did not have undue influence on the bank, as its stake had recently been reduced to 45.44 percent, and that there was therefore no rational or legal basis for blocking the funds. Ironically, the Hungarian minister’s draft letter arguing that Russia has no decisive influence over the IIB was commented and corrected during the document’s edits by IIB’s Russian Deputy Chairman, Georgy Potapov.

Although the Hungarian government has been a stable support for the IIB throughout this difficult period, within the bank they expect that after a while, this will be too little for them. In an email correspondence from September, a Russian staff member wrote that he believed that a situation could arise where “expropriation of Ru (state/private) assets in EU” can happen, and ”IIB as part of Ru assets can become subject”. In that case, either Russia would have to quit the bank, or the bank would have to leave the EU and relocate elsewhere.

“It is essentially the reappearance of a Wall between the West and Russia. We will be forced, one way or another, to locate ourselves on one side of that wall. Or seek third geographies without such a wall,” concludes CFO Auckland in the correspondence, which adds that because Hungary is part of the EU, the government’s room for maneuvering here could be reduced. “This may make it impossible to maintain [the bank’s presence] in the EU,” says the leaked email.

Contributors: Patrik Galavits (Hungary/Direkt36), Szymon Krawiec (Poland)

Infographic: Anastasiia Morozova (Poland/Frontstory.pl)

Cover illustration: Péter Somogyi (szarvas) / Telex

This article was also published in English and Hungarian on direkt36.hu, in Hungarian on telex.hu, in Czech on Investigace.cz and in Slovak on icjk.sk