Sergey Panov (The Insider)

Photo: GRS Ural 2025-02-20

Sergey Panov (The Insider)

Photo: GRS Ural 2025-02-20

Czech manufacturers of computer numerical controlled (CNC) machines have been exporting their products to the Russian market for decades. Even in 2020 and 2021, more than a tenth of Czech CNC machines, worth over a billion crowns, were sent to Russia. These machines often ended up being put to use by local arms and industrial companies, despite the ban on importing dual-use goods for military purposes. Investigace.cz, in collaboration with Russian exile editorial team The Insider, has traced the long-standing relationships between Czech producers—who continue to export machinery to Russia—and their Russian partners.

The Obukhov plant in St. Petersburg is nicknamed the “shield of the country.” In Tsarist Russia, it produced artillery for infantry; today, it assembles anti-aircraft weapons, including surface-to-air missiles supplied to the army. Among them is the legendary Russian S-400: an anti-aircraft missile system that Russian President Vladimir Putin has called the best defense system in the world. The Almaz-Antey Corporation, which includes the Obukhov Plant, has been on the European sanctions list since 2014.

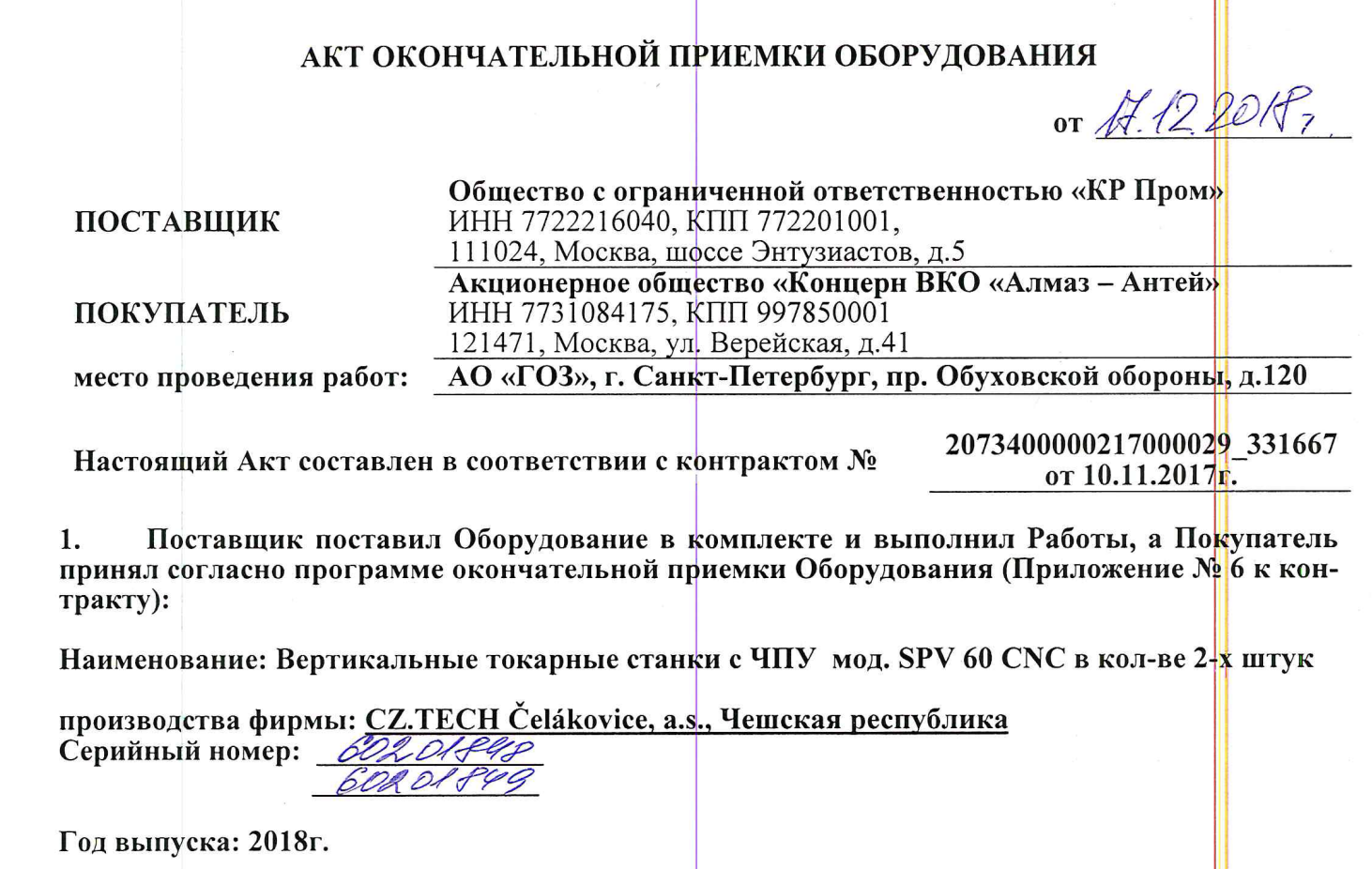

At the end of 2018, despite the sanctions, Russian company KR Prom unloaded a 44-ton shipment containing two CNC machines by the Czech brand CZ Tech Čelákovice on the premises of the St. Petersburg plant. These “smart” CNC machines are capable of precisely and automatically producing even the smallest components used in industries like engineering, energy, and arms manufacturing, including parts for missile assembly. Such machinery can have a lifespan of up to two decades.

Confirmation of the delivery of two CNC machines of the CZ Tech Čelákovice brand to the Almaz-Antey Corporation by the Russian company KR Prom. Source: zakupki.gov.ru

However, these were neither the first nor the last Czech-made CNC machines to end up in Russian factories producing weapons. This business has a long tradition in Russia, with interest in Czech industrial equipment growing significantly as early as 2008.

Russia Also Beckons

Back then, the Russian engineering market was highly sought after by Czech companies. Following the 2008 economic and financial crisis, domestic companies looked for new markets that had been less affected by the downturn—Russia being one of them.

“The expected recession will not affect all markets equally. Countries like Russia or China may not sink as deeply into crisis,” Jan Rýdl, the head of Czech CNC machine manufacturer TOS Varnsdorf and then-president of the Engineering Technology Association, told his colleagues in the machinery industry at the time.

Russia was also modernizing the industrial equipment in its manufacturing plants, creating strong demand for Western machinery.

The aforementioned company KR Prom was established at the turn of the millennium as a Russian distribution branch for the Czech company Kovosvit, originally operating under the name Kovosvit – Rus before adopting its current name in 2013. Its owner, Dmitry Rudenko, had already been involved in the Czech engineering sector for some time. Since 2008, he and his wife had owned the Czech supplier company Stanok, s.r.o., based in Tábor, and former Kosovit employees were among his Czech staff.

In 2013, Rudenko partnered with TOS Varnsdorf, a major player in the Czech engineering industry based in Ústí, to establish the manufacturing firm GRS Ural in Yekaterinburg. The company was designed to produce CNC machines using Czech components in Russia, with the Czech side holding a majority stake of 51%.

Another Czech engineering company, Alta, entered the Russian market as early as 2010. Specializing in exporting CNC machines to post-Soviet countries, Alta also owned the manufacturing brand TOS Kuřim at the time. Over the following years, the company successfully modernized production in several key Russian engineering enterprises, including the arms manufacturer Uralvagonzavod and the Ashinsky Metallurgical Plant—one of the main producers of special alloys used in the arms industry.

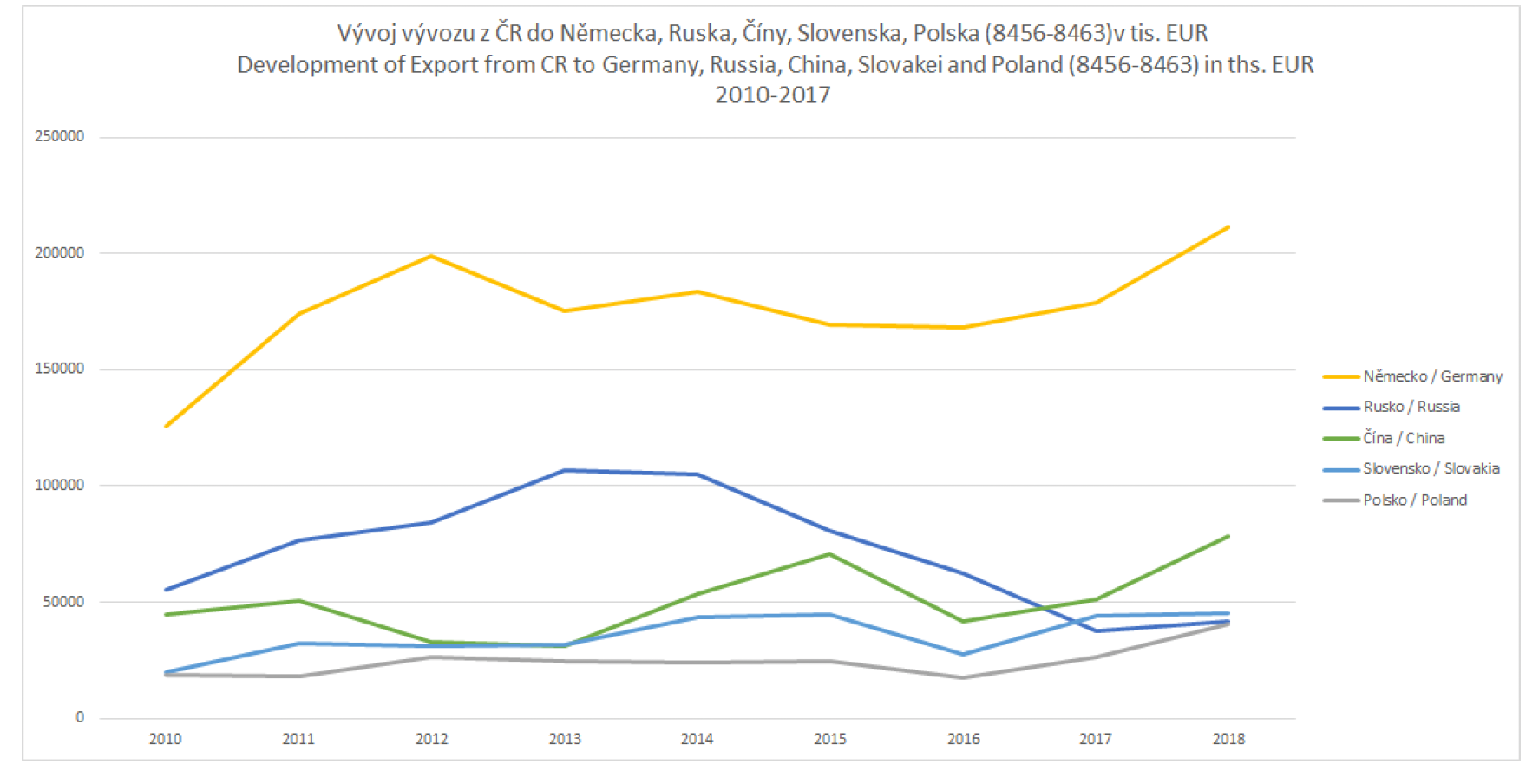

By 2013, Russia had become the second-largest market for Czech CNC machine manufacturers, with nearly a fifth of domestically produced machines destined for Russian industry. Russia, in turn, was heavily reliant on imports; by 2015, up to 90% of the machinery used in Russian factories came from abroad.

We Were Doing Well, Then Came the Sanctions

The successful Czech-Russian cooperation was significantly impacted by the annexation of Crimea in 2014—more precisely, by the sanctions that followed. That year, the EU imposed a ban on the export of so-called dual-use goods to Russia. This category included CNC machines, which are crucial for the defense industry.

Despite Russia’s aggressive foreign policy, the fast-moving train of Czech-Russian engineering cooperation did not come to a halt. During negotiations over sanctions in 2014, the Czech Republic requested an exemption for its engineering companies—and succeeded in obtaining it. As a result, the ban no longer applied to the export of dual-use goods for the aviation and space industries, or for non-military use or non-military end users. The exemption also covered ongoing contracts that were signed before 2014 and remained valid until 2022, when new sanctions were applied. Since then, the export of dual-use goods to Russia has been fully banned, regardless of their declared use or end user.

Former minister of industry and trade Jiří Havlíček (right) and a former director of GRS Ural Karel Andok. Source: TOS Varnsdorf

“We were doing well, but with the arrival of sanctions, especially after the Sochi Olympics, the situation worsened,” complained Roman Knotek, Rudenko’s Czech business partner and owner of a 10% stake in Stanok, a company specializing in the sale of CNC machines, in 2016.

Today, the company can be said to have navigated the new sanctions regulations successfully. By 2023, its revenues from services and sales of goods had exceeded 78 million CZK. But the continued involvement of at least part of its business in the Russian market is evidenced by an outstanding debt at the end of 2023: Russian distribution company KR Prom owed Stanok 103.5 million rubles (approximately 24.5 million CZK). KR Prom had previously violated sanctions in 2018 by delivering two 22-ton machines to a weapons plant in St. Petersburg.

Development of CNC machine exports to Russia from 2010 to 2017. Source: Svaz strojírenské technologie

Exceptional Engineering

In 2017, GRS Ural, owned by Rudenko and TOS Varnsdorf, gained domestic manufacturer status in Russia, allowing it to compete for government contracts. The company quickly capitalized on this status and supplied machines to the state-owned Morskoe Podvodnoe Oruzhie – Hydropribor, which specializes in naval weaponry. Another major contract followed in December 2018, this time for the State Laser Test Range Raduga, which develops and tests new weapons.

Five years after Russia’s aggression against Ukraine began in 2014, TOS Varnsdorf had not given up on expanding into the Russian market. As late as 2019, its CEO Jan Rýdl told the weekly Ekonom that he “would trade all other markets for the opportunity to become Russia’s sole supplier of engineering technology.”

“We have access to state tenders and the defense industry. It’s an amazing opportunity, and Russia is becoming our number one market,”* he added. Rýdl’s optimism was backed by figures: by 2019, GRS Ural had become one of the five largest Russian engineering firms producing CNC machines based on production volume and services provided.

While Czech exports of CNC machines to Russia initially declined after sanctions were imposed in 2014, the Russian market experienced a revival after 2019. By then, a tenth of the total Czech CNC machine exports were heading to Russia.

Quiet Cooperation

Rýdl’s enthusiasm was shared by other significant players in the domestic industry. In 2021, the Czech company TachTech, which is engaged in the sale and production of refractory materials, entered the Russian market, where it focused on the modernization of metallurgical industry infrastructure “with the aim of supporting the development of Russian engineering.” Successful Czech-Russian cooperation continued even after the beginning of the invasion of Ukraine in February 2022.

“We are a company with Czech roots, and we have good relations with Czechs, we are friends and we cooperate, but quietly,” admitted the head of TachTech’s Russian branch, Vyacheslav Korobeinikov, in an interview with journalists in 2023.

The strategy of quiet cooperation was also followed by CNC machine manufacturers themselves. In October 2022, the Czech-Russian company GRS Ural received from its Czech parent company, TOS Varnsdorf, machine components worth $73,000 (just under CZK 1.7 million). Thanks to this, the Ural company reported revenues of 594 million rubles (CZK 154 million) a year later, 50% more compared to the previous year.

In 2024, TOS Varnsdorf told independent Czech media outlet Deník N that it had terminated all its activities in Russia. Nevertheless, as late as April 2024, it published a recruitment advertisement in Russia for an electrician, and in May 2024, it signed a contract for the lease of a CNC machine to a Russian company that rents industrial equipment. In the second half of that same year, its subsidiary GRS Ural obtained permission to import Chinese machines into Russia.

Czech Machines and a Russian Icebreaker

In 2022, journalists from Czech weekly Respekt revealed that deliveries of Czech machines were making their way to Russia through Rudenko’s companies, Stanok and KR Prom. What caught their interest was a social media post by analyst Kamil Galeev, who managed to identify a Czech machine from TOS Varnsdorf in footage taken inside the Krasmash weapons factory. At the time, the Czech company told the Respekt journalists that the machine seen had been sold to the factory before the sanctions were imposed, and so was not a sanctions violation.

At the end of 2024, analyst Kamil Galeev pointed again to the role of Czech machinery in Russian industry – this time in the production of the brand new fourth nuclear icebreaker Yakutsk, which sailed through the waters of the Gulf of Finland at the beginning of the new year. Source: X

But at the end of 2024, analyst Kamil Galeev once again pointed out that Czech machines were playing a role in Russian industry—this time in the production of a brand-new fourth nuclear icebreaker, Yakutia, which sailed through the waters of the Gulf of Finland at the beginning of the new year. The nuclear reactors for the ship were produced by one of Rosatom’s state enterprises, which also uses foreign machines. In photos from 2017, CNC machines by Czech brands, including TOS Varnsdorf, can be seen in this factory.

According to last year’s calculations by data journalists from Russian exile newsroom IStories, two Czech brands—TOS Varnsdorf and Kovosvit—made it into the top 10 brands of CNC machines imported into Russia in 2023. Together, they imported goods worth 625 million rubles (CZK 162 million) into the country.

Big Fish

To legalize the export of machines to Russia, companies often use a scheme of fictitious sales to one or even several third countries, such as Turkey or Kyrgyzstan, which are not subject to sanctions. In export documents, there is often a note under the supplier stating that the machine was purchased, for example, by a Turkish company but at the request of a Kyrgyz company.

According to revelations by journalists from Deník N, this is how the Russian company Aljans imported TOS Varnsdorf brand machines. It used two Turkish companies and the Kyrgyz company Interstyle for the import. The Czech manufacturer told journalists that it was unaware of the real final buyer of its machines.

The contact phone number listed on the Kyrgyz company Interstyle’s website, according to our findings, belongs to a person listed in contact databases as “Kolja Moskva.” However, the company’s owner, as registered in the Kyrgyz commercial register, is Nurlan Shakirov, a resident of the capital city Bishkek, a passionate fisherman, and a regular participant in Russian fishing competitions. The captain of his fishing team is Nikolai Krylov, a Muscovite and the head of the Russian Aljans, which imported Czech CNC machines into Russia. Nikolai is colloquially known as Kolja.

Nikolai Krylov has long-standing experience with Czech manufacturers. His Instagram profile features photos from regular visits to the Czech Republic between 2013 and 2017. For example, in a 2016 photo, Krylov poses in a black coat with a briefcase during a presentation at the Czech engineering company TOS Kuřim. In 2018, Aljans supplied a CNC machine from this brand to one of the enterprises of the Russian state corporation Tactical missile weapons.

Nikolai Krylov (on the right), owner of the company Aljans, and Dmitry Petrov, his deputy, visiting TOS Kuřim in December 2016. Source: Instagram

Krylov’s company is still thriving. Its profit in 2023 increased many times over compared to the previous year. According to calculations by data journalists from IStories, the company imported machines worth a total of 601 million rubles, equivalent to 156 million CZK. Among its 2023 customs declarations are also machines from Kovosvit, TOS Varnsdorf, and the Slovak company Trens.

Fictitious Purchases for Real Arms Manufacturers

Over the past 10 years, numerous companies similar to Aljans have emerged in Russia, specializing in fictitious purchases of machines and their import into Russia. For example, the Russian company Your importer quotes a passage from Čapek’s The Gardener’s Year in its business motto: “Gardens can be established in several ways; the best is to take a gardener for it.” The company has been engaged in its trade—importing industrial machines from the West—since 2015.

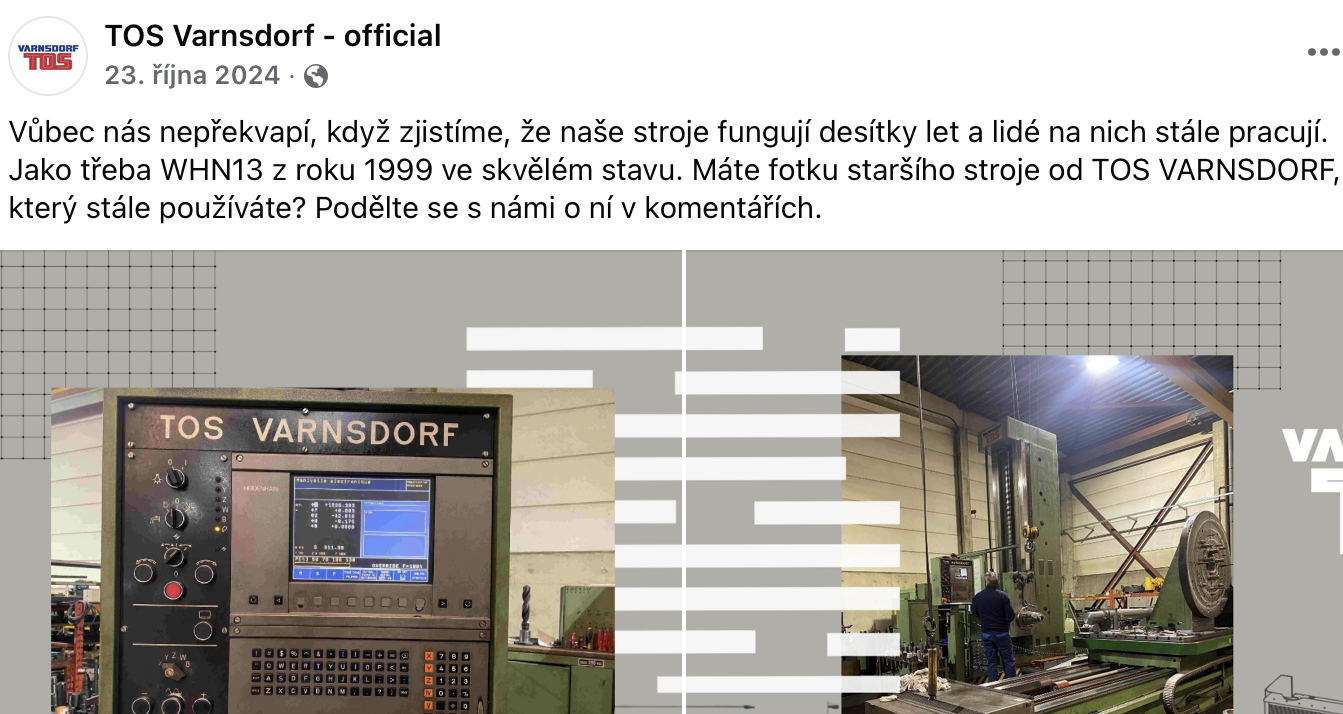

The lifespan of CNC machines can reach several decades. Source: TOS Varnsdorf

Last year, Your importer brought CNC machines from the Czech brand Comagrav (Comac spol. s r. o.) worth $231,000 (more than 5 million CZK). To import them, the company used a Turkish firm, which was placed on the U.S. sanctions list in October of the previous year.

“COMAC supplied a machine for advertising production to Turkey, and if the Turk resold it further, we can’t do anything about that. The machines are not geo-located, and they can be freely resold,” stated Rudolf Hladík on behalf of the manufacturing company Comac.

However, Russian companies are also interested in using CNC machines due to their long lifespan. For example, in 2023, the Russian company Technologics sold Czech machines that had been manufactured as early as 1998 or 2000. The Russian branch of the aforementioned company Alta (Alta-Rus) imported three used machines—by the brandsTOS Varnsdorf and TOS Kuřim—and a new machine from the Czech company ŠMT a.s. into Russia in the first half of 2022. The purchase was facilitated through the Latvian intermediary firm Michel.

The interest in used machines is no coincidence, as TOS Varnsdorf states on its Facebook page that its products can reliably function for decades. “We are not surprised at all when we find out that our machines have been running for decades and people are still working on them. Like the WHN13 from 1999, which is in great condition,” the company’s website states This suggests that the technological equipment supplied by Czech companies to Russia will serve the local arms industry well and for a long time.

The companies TOS Varnsdorf, CZ. Tech Čelákovice, Stanok, and TachTech did not respond to the editorial team’s requests for comment before the publication of this article. On the other hand, Alta informed us that it had not supplied machines to Russia and that the data was incorrect. However, as recently as July of last year, Alta-Rus obtained permission to import components manufactured by the Czech branch of Alta.

The Czech version of this story was published on investigace.cz.

Subscribe to “Goulash”, our newsletter with original scoops and the best investigative journalism from Central Europe, written by Szabolcs Panyi. Get it in your inbox every second Thursday!